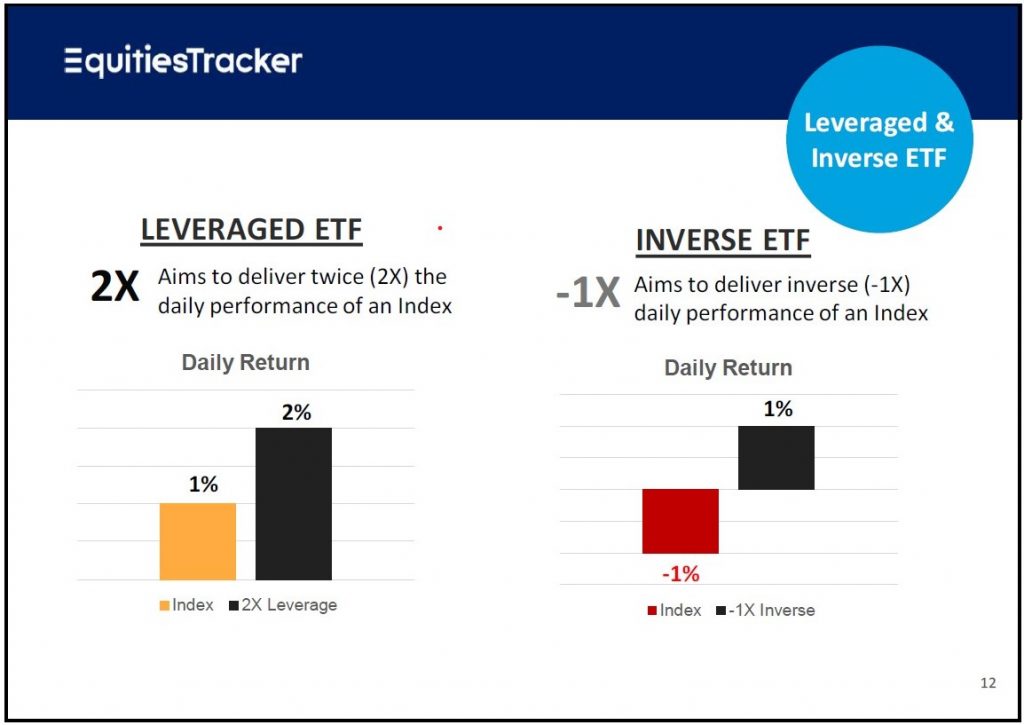

Bursa Malaysia - Leveraged and Inverse ETFs, are powerful short-term trading tools which allow investors to gain from either bull or bear market. Learn more at Bursa Academy. https://bursaacademy.bursamarketplace.com/en/article/equities/empower-your ...

:max_bytes(150000):strip_icc()/inverse-34f320b1d5a74b99b8212201837f16c4.png)